Introduction

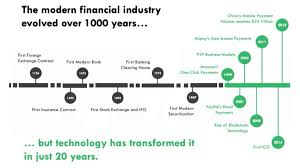

The financial industry has entered an era defined by rapid digital transformation. Innovations in technology are reshaping how individuals and businesses interact with money, investments, and financial services. Online platforms have gained massive popularity because they provide accessibility, speed, and global connectivity. However, with these advancements also come challenges that users must understand to stay safe and make the most of the opportunities available.

Shift Towards Online Solutions

The demand for online financial platforms has grown dramatically over the past decade. People prefer the ease of handling transactions, investments, and market monitoring from the comfort of their homes. Unlike traditional systems that require physical presence, paperwork, and long waiting times, digital services are designed for efficiency and convenience. This shift is influencing not only individuals but also corporations and global markets.

Benefits Of Digital Finance

Digital platforms offer several benefits that make them appealing in today’s interconnected world.

- Accessibility – Anyone with internet access can engage in financial activities.

- Speed – Transactions and trades are completed in real time.

- Global reach – Users can connect with international markets without limitations.

- Cost efficiency – Lower transaction fees compared to many traditional banking options.

- Transparency – Advanced technologies such as blockchain promote accountability.

Risks Of Relying On Online Platforms

While digital tools make life easier, they are not free from risks. Cybersecurity threats, fraudulent platforms, and misinformation are some of the major issues. Many inexperienced users have faced financial losses because they did not verify the credibility of the platforms they used. This highlights the importance of exercising caution and conducting thorough research before engaging in digital finance.

Safe Practices For Users

To reduce risks, individuals must follow best practices when engaging in online finance:

- Select platforms with proven reputations and strong security systems.

- Look for secure browsing (HTTPS) and two-factor authentication features.

- Avoid sharing sensitive data on unverified websites.

- Use unique passwords and update them regularly.

- Stay alert to unusual activity in accounts to detect problems early.

Role Of Education And Awareness

Education plays a vital role in building trust and confidence in online financial systems. Many individuals hesitate to use digital services because they lack knowledge of how these platforms work. Financial literacy programs, expert guidance, and user-friendly tutorials can help bridge this gap. By understanding the basics of online trading, cybersecurity, and digital payments, users can confidently navigate the financial landscape.

Comparing Traditional Banking And Digital Platforms

Traditional banking systems remain relevant, but their dominance is gradually decreasing. Many banks now adopt digital features Go immediate-revolution.org such as mobile apps, instant transfers, and online support to remain competitive. Digital-first platforms, however, continue to attract users through their innovative features and global reach. This coexistence is shaping a hybrid financial model where both traditional and digital solutions thrive.

The Future Of Finance

Looking ahead, the financial industry will continue to evolve with advancements in artificial intelligence, blockchain, and machine learning. These technologies will likely enhance personalization, security, and efficiency. Additionally, governments are exploring central bank digital currencies to merge traditional and digital systems. The combination of innovation and regulation could create a balanced and secure financial environment for users worldwide.

Conclusion

The digital revolution in finance is not just a passing trend—it represents a fundamental transformation. While online platforms provide accessibility, convenience, and transparency, they also come with risks that demand caution. By following safe practices, staying educated, and making informed choices, individuals can embrace these new opportunities confidently. The future of finance will be driven by technology, and those who adapt will be well-positioned to benefit from the changes ahead.